The Comprehensive Allowance Guide In Malaysia 2021 | Summary Of LHDN Tax Ruling Guide

When we talk about allowances, the top-management side may consider it as an additional payout on top of the regular salary wages.

However, depending on the type of allowance, some LHDN tax deductions are applicable, and you can meet both top-management and employees' expectations.

In this article, Seekers will share a review of 3 types of allowances with reference from the Inland Revenue Board of Malaysia (LHDN) tax ruling and how the allowances affect the tax payment.

We hope more HR people will get more insight about planning the best allowance-scheme!

Tax-exempted Allowances

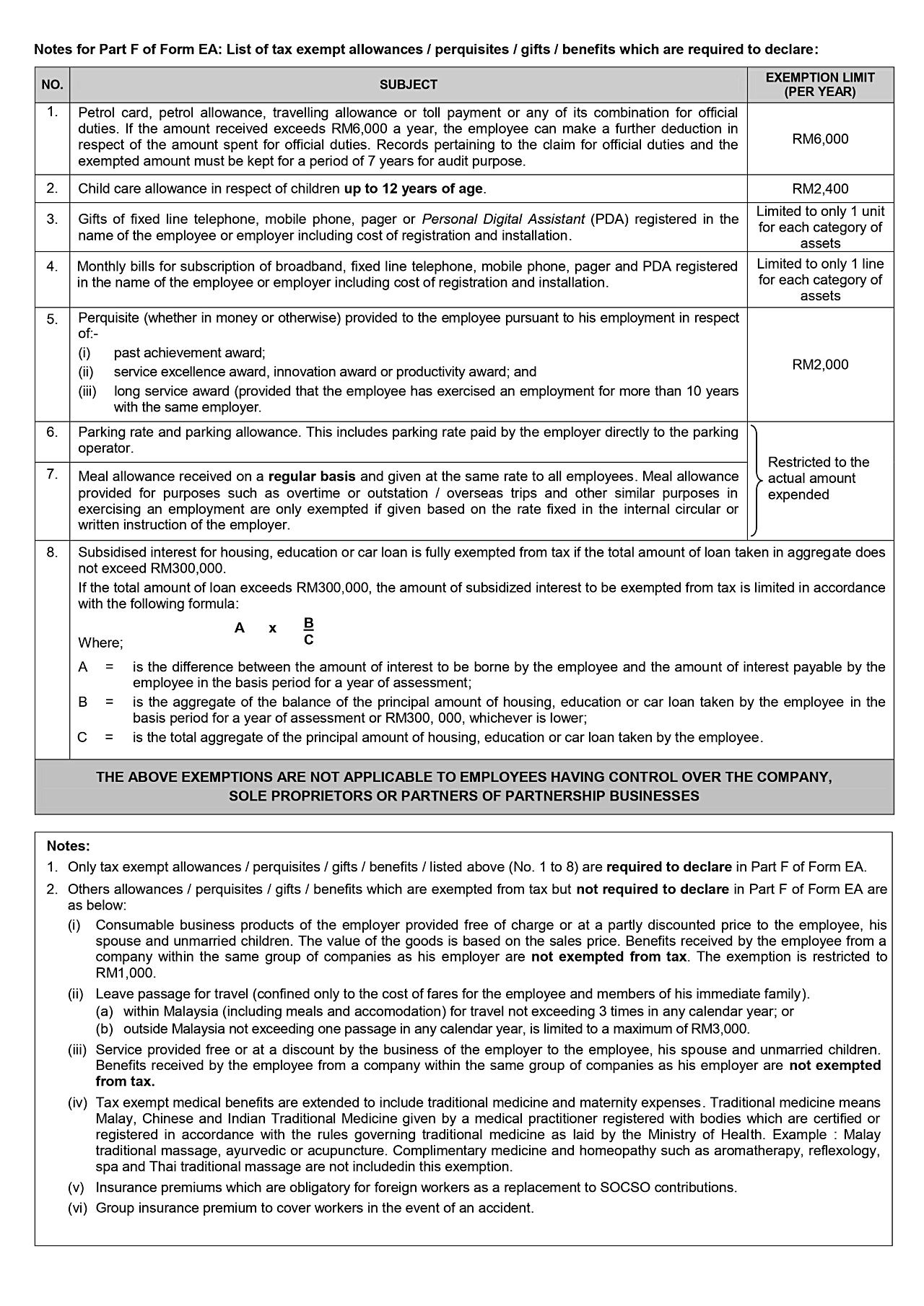

There are many types of allowances which are officially confirmed by LHDN as tax-exempted allowance.

*LHDN = Inland Revenue Board of Malaysia

For the reference of tax exempted allowances, here is the list of items and conditions:

Others Tax Exempted Allowances

There are also some other types of allowances which are not listed on the image we pasted on above. To know those, please check out the table below:

| Type | Details |

|---|---|

| Women returning to workforce | Talent Corporation Malaysia is encouraging women to return to work. The eligible returnee will be given an individual income tax exemption up to 12 months. |

| Retirement gratuity | With the condition, if retirement is due to ill health, the person is on the compulsory age of retirement & employment has lasted for 10 years with the same employer/same group's companies. |

| Gratuity paid out of public funds | Payment base on retirement from an employment under any written law. |

| Gratuity paid to a contract officer | Payment to a contract officer on termination of a contract of employment regardless of whether the contract is renewed or not. |

| Compensation for Loss of Employment | Eligible if the payment of compensation is due to ill health or termination after 1/7/2008 with an exemption of RM 10,000 for every completed year of service with the same employer/same group's companies. |

| Death gratuities | Fully exempted from income tax. |

| Scholarships | Any paid scholarship to an individual whether or not in connection with employment. |

For full listing from LHDN, refer here.

Major Non-tax-exempted Allowances

Since not all allowances are tax exempted, you should note these listing of Non Tax Exempted Allowances:

i. Benefits received by the employee from a company (or within the same group of companies).

ii. Car allowance/Mileage.

iii. Commission/Incentive/Bonus.

iv. Attendance allowances.

v. Shift allowances.

vi. Transport reimbursement.

Benefit In Kind

Benefit In Kind is a non-cash allowance. This benefit is treated as income of the employees.

The most common type of Benefit In Kind are:

i. Car.

ii. Residential Accommodations.

For further calculation on Benefit In Kind ruling, refer here.

Additional Info: Getting A Tax Deduction/Tax Incentive For Your Company

Yes, there is a tax deduction for employers in Malaysia, subjected to the terms and conditions set by the LHDN.

The list goes as follows:

i. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No. 3/2019 of Inland Revenue Board of Malaysia.

ii. Donation to NGO - Employers are eligible for tax deduction under Section 44 (6), Income Tax Act 1967.

iii. Zakat Contribution - Zakat paid by companies to Islamic religious authorities is allowed as a deduction under Income Tax Act 1967 .

iv. Incentive for a Qualifying Research and Development Activity - Employers involved in R &D are eligible for special deductions in accordance to Public Ruling No. 6/2020 of Inland Revenue Board of Malaysia.

v. Tax Incentives for BIONEXUS status company - Company listed under this special status is entitled for tax incentives under Public Ruling No. 1/2020 of Inland Revenue Board of Malaysia.

NOTE

The tax incentive/tax deduction and types of allowances are for references purposes for now. There may be changes of listing and regulation along the way from Inland Revenue Board Of Malaysia.

Source: Inland Revenue Board Of Malaysia, Talent Corporation.

Specialist Recruitment Management Services in Malaysia

Seekers Malaysia is a results-driven, performance-based headhunting service that provides career consultancy, corporate support, and recruitment management services to help employers find and hire specialist talents across different digital and technological fields of expertise.

Our unique approach of combining technology with an extensive database of over 22,000 freelance recruiters allows us to quickly and efficiently identify and locate highly skilled and experienced professional talents best suited for your business goals and needs.

Learn more about our headhunting services or contact us to discuss your recruitment needs. We look forward to helping you find the right talents to drive your organisation’s growth.